2024 Referendum Talking Points

FAQs

There are two types of referendums a district an ask voters to approve: capital and operational. A capital referendum funds building construction/renovation. An operational referendum helps cover ongoing expenses associated with running a school district.

Operational referendum money cannot be spent to renovate or build facilities, and capital referendum dollars cannot be spent on school operations.

The Mineral Point Unified School District is seeking approval of an operational referendum on the November 5, 2024 ballot.

Why are referendums needed?

Wisconsin public school districts are mainly funded by a combination of state money and local property taxes. Despite a $7 billion surplus in the state general fund, state aid has decreased relative to inflation for more than a decade. That means most districts require more money from local taxpayers to operate. Federal COVID-19 pandemic aid (ESSER funds) are no longer available to schools starting in September 2024.

State aid for public schools was previously tied to inflation but has not been since the fall of 2009, resulting in less money for districts.

In 2022-23, state funding was $3,235 less per student than if it had been tied to inflation since the 2009-10 school year, according to the Wisconsin Legislative Fiscal Bureau.

Unless the school funding formula and state funding noticeably improves, referendums will likely be more common.

Is referenda a state-wide issue?

On the April 2024 ballot, there were 103 referendum questions in Wisconsin, 68 of which were operational referendum questions, the largest share of operating referendums since at least the year 2000, according to the Wisconsin Policy Forum.

This year, a record total of 146 school districts will have gone to operating referendum in 2024, which far exceeds the 2022 record of 92.

As of this writing, there are 80 schools in the state with an operational referendum scheduled in November. Locally, those in CESA 3 (southwest Wisconsin) include Argyle, Belmont, Cuba City, Darlington, Dodgeville, Iowa-Grant, Ithaca, Mineral Point, Platteville, Prairie du Chien, and River Ridge.

In April 2024, the following local CESA 3 schools held successful operating referendums: Barneveld, Highland, Potosi, Richland, and Southwestern.

I hear about state revenue limits. What do those mean?

In 1993, the State of Wisconsin imposed revenue limits, which are in effect, spending limits on public schools. These limits had been indexed to inflation until 2009. Since then, while school costs continued to rise, the revenue limits have not increased accordingly. In fact, for six of the past ten years (2015-16 to 2024-25), school districts received no allowable increase, even as wages, utilities, and other operational costs went up. To make ends meet, school districts have had to cut expenditures, spend down reserves, and/or ask voters for more revenue authority through referendums.

What will the money be used for?

The increase in revenue authority is needed to meet basic needs and to maintain existing programs. The kinds of expenditures we need to cover include wages, utilities, transportation, insurance, food service, special education costs, and the co-curricular programs we offer, to name a few. An operational referendum allows the District to maintain educational programming and class sizes, retain and attract staff, stay current with technology, building maintenance, and safety.

How was the dollar amount determined?

In addition to our internal analysis, we’ve consulted with Baird Financial (a company that works with hundreds of school districts) and used their proprietary software to forecast our expenditures and revenues for the next five years. The Baird model predicts compounding deficits for this school year and for the years in the future.

What is a Fund Balance and what are the advantages of having a healthy Fund Balance?

For the current 2024-25 school year, the District will use Fund Balance (“rainy day fund”) to cover our projected budget deficit. It is also a combination of cash and physical assets, such as computers or district-owned vehicles. Spending down reserves is unsustainable. Our Board policy states the Fund Balance must be no less than 15% of the total operating budget.

The Board of Education recognizes the need to maintain an operating reserve in the general fund for the following purposes: 1. Hold adequate working capital to meet cash flow needs during the fiscal year. 2. Reduce the need for short-term borrowing. 3. Serve as a safeguard for unanticipated expenditures of the District. 4. Show fiscal responsibility to maintain a high credit rating which will help reduce future borrowing costs.

Without a successful referendum, the District’s Fund Balance will drop to 14.25% next school year, putting us in violation of our own School Board policy of a Fund Balance of at least 15%. In four years, the Fund Balance would be completely depleted.

How has enrollment changed in the last several years?

This dedication by the staff has helped increase the number of families that want their children to attend Mineral Point, and unlike many southwest Wisconsin districts, we are very fortunate to have more students enrolling, both through moving into the district and open enrolling from other schools. Increased enrollment also brings with it an increase in state aid, just not enough to keep up with the rising costs of operating the school district. Without the desire for more families to send their children to Mineral Point, we would likely be looking at an even bigger referendum dollar amount. In 2023-24, our enrollment (resident and open) as reported by the Wisconsin Department of Public Instruction was 782 students. Ten years ago, that number was 732.

Open-enrolled students come with state aid from their home district to help offset costs with their attendance. Being cost-conscious, the District has closed open enrollment in some grade levels and for some specific programs where additional students would mean we would need to hire additional staff. In 2012-13, 35 students open enrolled into the District and this year in 2024-25, that number has risen to 105 students choosing Mineral Point over their resident district.

In comparing the 48 school districts in the 17th Senate District, Mineral Point ranks 6th in total dollars generated through open enrollment. (Source: Senator Howard Marklein newsletter 8/23/24)

It’s important to note we close open enrollment at certain grade levels and for certain services so we do not need to hire additional staff to support students who don’t reside in our district at the expense of the local taxpayer.

MP Open Enrollment History Blue is Open Enrollment into the District; Gray is Open Enrollment out.

Will this money be used to finish renovations to the football field?

By law, an operating referendum cannot be used for facility improvements outside of routine maintenance to existing facilities. The renovations that are ongoing for the Stadium Project are from private donations, not District/taxpayer funds.

When was the last time the District brought an operational referendum to voters?

The voters of the Mineral Point Unified School District approved an operational referendum in the amount of $350,000 recurring in November 2018. We remain grateful for this support. At the time, it was projected we would be back asking for additional funds in three years. However, due to fortunate financial circumstances and strategic decisions, we are now returning to ask six years later instead of three.

There’s been a lot of talk about ESSER funding during the pandemic. Where has that money gone?

Some conversations are taking place around the ESSER money each school district received during the pandemic, and why we did not keep some of that money to use later. Each school district received these federal funds in three payments, and each payment had a deadline to spend the funds. The last round of federal funding prompted the state legislature to not provide any additional funding to schools. The ESSER money was intended to address one-time expenses relating to gaps in student learning, mental health needs, and maintaining a clean environment. The legislature told schools to spend the money on ongoing expenses, like salaries, in order to balance our budgets. In Mineral Point, we tried to spend the money as wisely as we could until we did not receive any support from the legislature in 2021-22 and 2022-23. The deadline for spending the last round of ESSER funding is September 30, 2024. Any money not spent by that time will be returned to the federal government. There was no opportunity to save it for future financial problems.

What has the District done to address recent fiscal challenges?

The district remains committed to the responsible stewardship of every dollar with strict accountability measures, including an annual audit from Johnson Block & Co.

The District has made tough choices in order to balance its budget in past years.

Below is a non-exhaustive list of some ways the District has cut costs in recent years:

- Paid less than CPI for staff wage increases in several recent years

- Increased staff share of insurance (Point of Service vs HMO)

- Used ESSER money to offset increases

- Increased successful grant applications

- Cuts to the technology budget

- Cuts to the maintenance budget

- Moved technology expenses to ERate (60% reimbursement) [24-25 school year]

- Brought back the food service program under the District’s umbrella (no more management fees)

- Competitively bid on large projects (transportation)

- Reduced lease agreements (copiers/printers)

- Staff have already been held to salary/step/lane freezes in past contract years

- Have not funded all steps on the salary structure (steps, lanes, etc)

- Use what is known as Train the Trainer model (one person attends Professional Development then shares out)

- Frozen or reduced classroom budgets

- Extended the life of curriculum and technology before updating

- Pushing of classroom furniture purchases

- Purchased programs (IXL, Apex, etc.) through CESA instead of individually as a District

Below is a non-exhaustive list of some ways the District has raised additional revenue in recent years:

- Took over Options In Education School from CESA 3 (Other Districts can purchase seats to have their students attend)

- Increased revenue in interest income

- Open Enrollment (plus 105 for the 2024-25 school year) {10 years ago it was plus 35}

- Advertising sales through Pointer Media for athletics

- Fund 46 Capital Maintenance Fund

- Excellence In Education Endowment Fund provides grants to classroom projects through private donations

- Booster Group financial support

- Youth Apprenticeships – local businesses that provide work options

I’ve heard about a “historic investment” in education. Can you explain?

While the investment was historic, it wasn’t so impactful for public schools as it was for private. This bipartisan shared revenue deal signed by Gov. Tony Evers included the largest expansion of government funding to private voucher schools in the program’s history.

In the last state budget, Gov. Tony Evers used the veto power afforded to him by the Wisconsin constitution to alter a part of the budget that provided an annual increase in base aid to districts of $325 per student for the 2023-24 and 2024-25 school years. The governor struck the “20” and the hyphen from “2024-25,” setting the year 2425 as the new end date for the annual increases. However, there is a lawsuit in play that could overturn this veto. Additionally, future lawmakers could decide to roll back the mandatory increases.

The state budget also expanded private school vouchers by up to almost $3,000 per student, or nearly ten times more, than what public schools received.

How much money does the district lose each year to the Milwaukee Voucher Program?

Mineral Point lost approximately $349,000 over the last five years to the Milwaukee & Racine Voucher Programs. This is money taken from Mineral Point taxpayers to fund charter schools in Milwaukee and Racine. These are real dollars lost out of the classroom for Mineral Point students.

How does Special Education affect the school’s total budget?

We only receive 33% reimbursement from the state for special education costs. This means, last year alone, we had to divert $1.2 million from the general education fund to cover special education. There has been talk about the need to raise the state’s special education reimbursement rate, but lawmakers have not done so.

How much will my taxes go up?

The School Board has stated its plan to use debt defeasance in an effort to keep the mill rate steady. Current estimates suggest that the tax impact would be $62 for every $100,000 of property. The school funding formula is complex with dynamic variables. The Board is committed to using only the amount of revenue authority necessary to maintain current programs and does not intend to levy the full amount unless it is absolutely necessary each year.

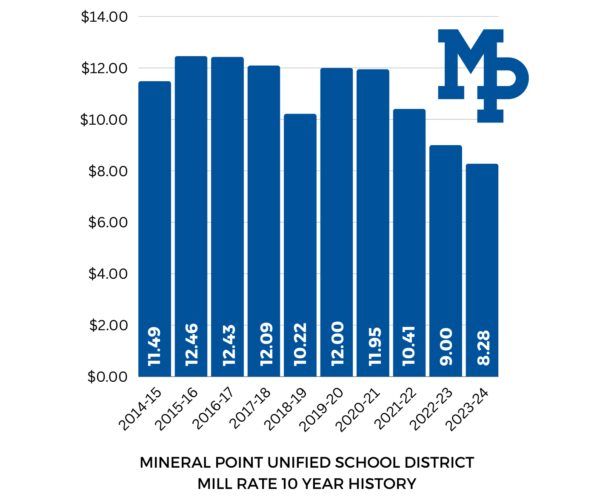

What has the mill rate been historically?

For every year since 2019-20, the mill rate has been decreasing, even with the referendum approved by voters in 2018. Final levy and mill rate information will be presented in October when equalized values are finalized by the Department of Revenue.

Each year, the Mineral Point Unified School District tax levy is divided by the total equalized (fair market) property value within the school district boundaries and its municipalities. The ratio this creates is multiplied by 1,000 to create what is referred to as the “mill rate.” The mill rate represents a tax rate per $1,000 of equalized property value. School districts report mill rates based on equalized value to ensure a uniform distribution of shared taxes across municipalities.

The mill rate is a common measure of representing the rate of taxation by a taxing entity. Once the proportional share of a school district tax levy is passed on to a municipal entity, that amount is levied on all taxable property within the district boundaries based on their proportional share of a City’s or Town’s assessed property value.

If we need money to run the school district, why did staff receive pay raises this year?

The current K-12 landscape finds an ever-increasing demand for quality educators. The District believes in attracting and retaining top-notch staff members and is one of three main priorities approved by the School Board. Unfortunately, fewer individuals are entering the field of education as a career path, which means there are fewer candidates for open positions than we used to see even just five to ten years ago. Being able to provide a competitive salary and benefits compared to area districts is becoming increasingly more important in attracting the best staff to serve our students.

Over the last three years, the consumer price index (CPI) has increased by a total of 16.82%. Salaries for staff members are tied to the CPI but the District budget has not been able to provide the same level of increases. In the 2022-23 school year the District paid 3% instead of 4.7%, in 2023-24 the District paid 6% instead of 8%, and finally, in 2024-25 the District will pay the 4.12% increase. If you compare that number to 2021-22, CPI raises were 1.23%. Additionally, staff have been asked to pay more out of pocket for prescriptions in the last few years in an effort to keep District costs down, and many employees have switched to an HMO health insurance plan instead of paying the difference out of pocket to keep a Point of Service plan. We are continually evaluating our staffing levels to best serve students in an effective and efficient manner. Whenever we have a vacancy due to retirement or resignation, the Board and administration take a close look as to whether or not we need to replace that position.

How does the District fare when it comes to per pupil spending compared to others?

In comparing the 2019-20 school year to the 2022-23 school year, of the 48 school districts in the 17th Senate District, Mineral Point ranks 3rd to last in the percentage increase in per pupil spending.

(Source: Senator Howard Marklein newsletter 8/2/24)

Is the District punished by the state if the referendum fails?

Current school finance law states if a school fails an operational referendum, that district will be financially penalized by the state by disallowing any low revenue ceiling increase to benefit the district for the following three years, or until a subsequent operational referendum passes.

What is the School Tax Levy Credit?

The Department of Revenue calculates a tax credit each year based on total school district levies in the State of Wisconsin. These credits are automatically applied to individual tax bills and indicated by a box stating “School taxes reduced by school levy tax credit” on your tax bill. The school levy tax credit is not paid to individual school districts.

What happens if the referendum fails?

A significant budget deficit will need to be addressed this school year with larger deficits looming in the future. Reductions will severely impact the quality of education our community has come to know and expect from our schools. Our forecast models predict the Fund Balance will be depleted completely within four years. In the interim, the Board would need to make extremely tough decisions and program reductions could include everything from academic offerings, co-curricular activities, and staffing — resulting in larger class sizes and fewer opportunities for students. With fewer opportunities, it is possible the students open enrolling to our school district would leave for other districts, taking additional state aid money with them, compounding our financial concerns.

Where do I learn more on when, where, and how to vote?

The election is Tuesday, November 5. You may vote on or before that date. Visit myvote.wi.gov for info on: voter registration, photo id requirements, early voting, polling places, absentee voting.